Mauritania: Mauritania Communication Profile

2015/11/01

Mauritania Mobile Operator Estimate, 2010 - 2014: Mauritania to have 4.2 million mobile subscriber connections in 2014 with Mauritel taking 57.5% market share

Sitting on the edge of the Sahara desert, Mauritania's terrain is mostly barren, including the flat plains of the Sahara. Most of the people is concentrated in the cities of Nouakchott and Nouadhibou and along the Senegal River in the southern part of the country. The urban people constitutes over 40 % of the total as at 2008.

Due to a deficit in electricity production ranging from 7 to 17 % in the hot season, Nouakchott, the capital, experiences frequent power cuts. As a result, power is rationed in amount neighbourhoods and it does not exceed hours in a row per neighbourhood. The government expects that ongoing projects will help to improve supply, aiming to reach electricity coverage of 50-80 % by 2015. The French Development Agency is to grant Mauritania EUR 20 million in 2011 half to reform the electricity sector.

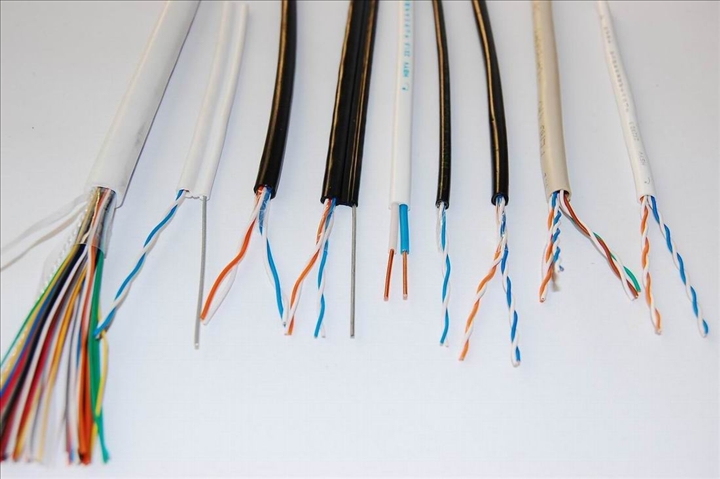

Due to the country’s geographical features, satellite broadband seems to be the majority common solution in remote areas. For example of the satellite services is SkyOne-IP broadband, a-way satellite Internet transfer (VSAT) system which provides Internet access in the least accessible areas. A domestic satellite telecommunications system links Nouakchott with regional capitals. The remaining telecoms infrastructure consists of a limited system of cable and open-wire lines. Small scale FWA private networks are as well being deployed. The serve either private networks (mining, oil companies etc) or are small ISP deployments.

Most of the legacy telecom networks comprise outdated infrastructure inherited from French colonisation. As local resources were limited, to attract the necessary investment, in 2001 Mauritania started privatising its telecoms sector. With the privatisation of Mauritel, the market was in theory opened to competition; however the incumbent operator remains the monopoly provider of fixed-line services.

Fixed-line penetration by people is only 2.4 % of the lowest in the world. Between 2008 and 2009 it fell by 2 %. Data and communication technologies remain a luxury for the predominantly Bedouin and tribal society, characterised by the traditional way of life. However, the Internet has become an significant component of Mauritanian education, with an increasing number of students using Internet cafes for online research.

Incumbents

Mauritel was established on 1 January 2000, following the separation of the postal and telecommunications activities of OPT (Department of Postal and Telecommunications Services). It was privatised in 2001 when Maroc Telecom acquired a 54 % stake in the company. In January 2002, Maroc Telecom Group established the Mauritanian Communication Company (CMC) to which it transferred its holdings in Mauritel. On 6 June 2002, the Group sold a 20 % stake in CMC to the local firm, Abdallahi Ould Noueigued (AON).

Today, Maroc Telecom holds 51.5 % of the voting rights of Mauritel, following the merger of Mauritel SA (fixed-line) and Mauritel Mobile. Mauritel provides mobile services via a subsidiary, Mauritel Mobile.

Mobile

During 2000-2010, mobile penetration in Mauritania grew from 0.64 % to 87 % of the people. During the same period, the country’s three mobile operators invested USD 500 million, excluding the fees paid for licences. Mobile phone lines constitute around 97 % of amount phone lines in the country. Mauritel is the leader of the mobile market with a 54 % market share (Q410) and 1.696 million mobile subscribers (Q111), up from 1,547,000 in Q210.

However, the rival Mattel, as well known as La Mauritano-Tunisienne De Telecommunications, was the first operator to receive a mobile licence in May 2000. Mauritel was awarded a licence later in the same year without the need to participate in a competitive bidding process. It launched Mauritania’s second GSM network in November 2000.

Country’s third mobile operator, Sudatel's subsidiary Chinguitel won 2G and 3G licences in September 2006, having submitted a bid nearly times higher (USD 100 million) than the price paid by Mattel. (The second 3G licence was granted to Mauritel). Chinguitel was as well granted local loop licences for local and national voice services and Internet access. In August 2007, Chinguitel launched 3G services providing coverage of 4,000 km of major routes throughout the country. In addition, in 2009, Chinguitel was granted 55 MHz channels in the 18 GHz band to expand its transmission network in the major cities including Nouakchott and Nouadhibou. It was as well allocated the national spectrum, including 10 MHz in the 1800 MHz band and 5 MHz in the 2.1 GHz band to extend its CDMA and WCDMA networks. In May 2011, the company launched its new UMTS 3.75 G network that will work alongside the 3G network.

As in the case of fixed telephony and broadband, satellite technology is as well widely used for mobile communications. In June 2003, Mauritel Mobile contracted interWAVE to supply a GSM solution to connect remote GSM network extensions to the capital city, Nouakchott, via satellite. It was expected to provide additional than 50 % satellite bandwidth savings compared to competing GSM solutions. Likewise, in December 2004, in order to support the expansion of its mobile network, Mattel moved amount traffic onto the Intelsat satellite system.

Mauritania’s mobile network coverage extends mainly to urban areas. Mattel's network covers 70 % of Mauritanian cities and 80 % of the people. Chinguitel was present in 39 cities and towns by 2009. Mauritel's network covers 69 cities and towns, including 37 locations covered by the fixed network.

Competitive Landscape

At end-2010, Mauritania’s fixed-line and internet market was split between operators: Mauritel and Chinguitel, since Mattel had not from now on launched its fixed-line network. In Q410, Mauritel held a 55 % share of the fixed-line market with 41,000 fixed-lines (down from 42,000 in Q210) and 7,000 Internet customers. The incumbent offers Internet access via PSTN, ISDN, leased lines and ADSL, launched in 2006. Its local network includes standard wire cables and wireless local loop (WLL). Mauritel is as well relying on satellite technologies. Its satellite transmission network is 97 % digital and operates using satellites. These satellites are Intelsat, serving direct traffic and transit traffic to Europe, the Americas, Africa and the rest of the world; and Arabsat, serving regional and domestic traffic.

Despite difficult terrain, Mauritel is investing in fixed infrastructure. In May 2011, the operator launched a MRO 3 billion cable project which will link Nouakchott to Kobonni via 24 fibre-optic pairs. Mauritel chose Huawei to implement the network which will have an initial capacity of 2.5 Gbps and will be able to facilitate a capacity of 40 Gbps in next. The backbone will provide broadband capacity to the towns and villages along its path. It could as well serve as a thoroughfare for mobile Internet communications.

Outside the country, Mauritel has been investing in submarine and terrestrial cross-border cable systems in a bid to lower bandwidth costs. In October 2006, it rolled out a second data link on SAT3 (South Atlantic 3/West Africa Submarine Cable) with a bandwidth capacity of 45 Mbps. As a result, Mauritel's fibre capacity increased to 79 Mbps, including an before 34 Mbps link with Telefonica. Mauritel did not disclose what it was paying for SAT3 capacity, particularly the stretch from the Mauritanian border to Dakar. However, according to sources this bandwidth was "expensive".

In May 2009, Maroc Telecom announced plans to deploy a new fibre-optic cable through the Western Sahara into Mauritania. This is expected to give Mauritania a competitive alternative to using SAT3 through Dakar. Furthermore, in January 2011, The European Investment Bank allocated EUR 8 million to fund 35 % of the cost of the first fibre-optic cable linking Mauritania to Europe and West Africa. The Cable ACE (Africa Coast to Europe) project, initiated by France Telecom, will result in a 17,000 km cable along the west coast of Africa, to be used by the three Mauritanian telecom providers. It is claimed it will provide cheaper Internet access than the satellite connections now in use. An economic interest grouping (EIG) was created including Mauripost (the national postal service) and the three Mauritanian operators involved in ACE, under France Telecom's management. Mauritel owns 20 % of this EIG.

Meanwhile Mauritel’s rival Chinguitel is focusing on wireless technologies. At the end of 2008, Chinguitel started deployment of the mobile WiMAX network using the 2.5 GHz spectrum, with the view of creating a CDMA and WiMAX integrated network infrastructure. Its current broadband offering includes up to 1 Mbps mobile broadband, in addition to a 153 Kbps dial up service.

Developments

Pricing and Tariffs

As of Q311, Mauritel's entry level ADSL tariff with 256 Kbps download speed was priced at MRO 5,700. The highest speed tariff had a 4 Mbps speed and was priced at MRO 55,882.

Broadband Statistics

At the end of 2010, there were around 7,000 DSL subscribers in the country. This figure was slightly up from 6,530 at the end of 2009 and from 5,876 at end-2008. At the end of 2010, broadband penetration part people stood at 0.2 %. Unsurprisingly, mobile Internet is much additional popular than fixed broadband, though still very thinly spread. As of end-2009 there were just over 22,000 mobile Internet subscribers. This figure includes GPRS, CDMA, UMTS, 1X, EVDO technologies.

|

Country

|

Technology

|

Unit

|

Total

|

Total

|

Total

|

Total

|

Total

|

Total

|

|

|---|---|---|---|---|---|---|---|---|---|

|

2010Q3

|

2010Q4

|

2011Q1

|

2011Q2

|

2011Q3

|

2011Q4

|

||||

| Mauritania | ADSL | Subscribers | 7,000 | 7,000 | 7,000 | 7,000 | 6,530 | 7,000 |

Regulatory Developments

The Department of Postal and Telecommunications Services (OPT) was established in 1997 as an independent statutory body. In 1998, the Government announced a sector reform centred on key principles:

• The separation of the postal and telecommunications services into distinct companies, with financial and managerial autonomy, and subject to specific regulation;

A new telecommunications law was adopted in July 1999. The law redefined the institutional framework of the telecommunications sector with a view to market liberalisation and increased private sector participation. It as well separated the management and regulation of the sector. In 2000, OPT was split into separate companies: Mauritel for telecommunications services and Mauripost for postal services.

A new regulatory entity (Regulatory Authority - Autorité de Régulation) headed by individuals who cannot be affiliated with the telecommunications sector, was created and put in charge of developing:

The role of the Regulatory Authority is to oversee the application of the Law and its decrees. In particular, it organises and oversees the bidding for licences and provides the required authorisations. It as well makes decisions regarding the suspension and retraction of licences which is conveyed to the Minister of Telecommunications. The Regulatory Authority is as well in charge of defining the rules with regards to:

The Ministry of Telecommunications oversees the telecommunications sector and defines the policy for the development of the sector, particularly the universal access policy. The Minister has the authority to grant, suspend and retract licences, as decided by the Regulatory Authority.

.mr

- Mauritania News

-

- AFGHANISTAN: UNWTO: International tourism – strongest half-year results since 2010

- BOTSWANA: Why governments need to support the financial sector to meet the unserved needs of smallholder farmers

- BOTSWANA: International Arrivals To Africa Reach More Than 18 Million In 2017

- BOTSWANA: Africa: USA-Africa - No Policy? Bad Policy? or Both?

- BOTSWANA: Africa: U.S. State Department To Get Experienced Diplomat in Key Africa Post

- BOTSWANA: Africa’s economic growth in 2016 was driven by East Africa

- Trending Articles

-

- WORLD: Five reasons why global stock markets are surging

- JAPAN: Carmakers face billions in European CO2 fines from 2021

- CHINA: Going green: the changing face of corporate finance

- PAKISTAN: Nawaz Sharif to become PML-N chief again?

- CHINA: The downsides to Singapore’s education system: streaming, stress and suicides

- FRANCE: UK growth will trail Italy, France and Germany next year, says OECD