Southern Africa: Sub-Saharan Africa: importance of institutions for developing food and agriculture value chains

2015/12/05

Despite its huge food and agricultural potential, Sub-Saharan Africa’s agricultural production has barely kept up with people increase as productivity increase has lagged behind. Over the completed decades the region has become a net food importer. Food and agricultural trade deficits are on the rise, posing risks to food security. Conference this challenge requires the region to develop its role in food and agricultural price chains.

It should move from predominantly smallholder production for informal markets and export of (agricultural) commodities to adding additional price at different stages in the price chain. Possibilities for doing so depend crucially on climatological and soil circumstances and on the presence of enabling factors. The degree to which nations provide an enabling environment differs largely across the region, and is strongly linked to nations’ in general institutional development, as is shown by investigating a set of relevant indicators.

- Sub-Saharan Africa’s widening food and agriculture trade deficit is a huge challenge in view of population growth

- Developing the region’s role in food and agriculture value chains offers opportunities for growth

- The enabling environment for developing food and agriculture value chains differs widely across the continent and is strongly linked to broader institutional development

Sub-Saharan Africa’s widening food and agricultural trade deficit is a huge policy challenge

‘Africa remains a predominantly rural continent’ (Africa Economic Outlook 2015).[1] For Sub-Saharan Africa as a whole, agriculture contributes 14% of GDP. But for a lot of nations in the region, agriculture is one of the larger or the major sector in the economy(Figure 1). Much of the region’s agricultural activity takes place in the informal economy. This has significant negative implications for the completeness and reliability of data.

Over time, Africa has become a net food importer. The major reasons for this are people increase, low and stagnating agricultural productivity, policy distortions, weak institutions and poor infrastructure (Rakotoarisoa et al., 2011). Figure 2 (yield gap) and 3 (total factor productivity increase[3]) illustrate that African agricultural production falls short of potential to a much higher degree than is the case in other continents.

Over time, Africa has become a net food importer. The major reasons for this are people increase, low and stagnating agricultural productivity, policy distortions, weak institutions and poor infrastructure (Rakotoarisoa et al., 2011). Figure 2 (yield gap) and 3 (total factor productivity increase[3]) illustrate that African agricultural production falls short of potential to a much higher degree than is the case in other continents.

At the same time, the agricultural potential of the region is huge. Importantly, the potential supply of land for agricultural purposes holds enormous promise, but at the same time, sufficient circumstances for developing such land, such as adequate infrastructure and arrangements for landownership rights, are often not from presently on in place (Figure 4).

Not only has sub-Saharan Africa become a net food importer, but the food and agricultural trade deficit continues to widen too. Rakotoarisoa et al. (2011) point out that between 1980 and 2007 domestic food production increased by only 2.7 % per year, just barely above the people increase rate over this period. This implies that any increase in per capita consumption had to be met by an increase in imports. Additional recent data suggest that this trend is continuing: Figure 5 shows a rapidly growing trade imbalance.

Developing Sub-Saharan Africa’s role in (world) food and agricultural price chains offers opportunities for growth

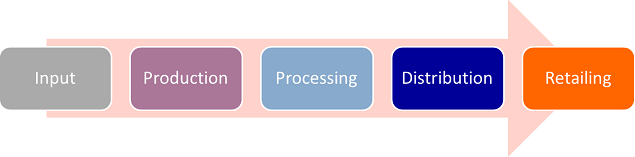

Conference Sub-Saharan Africa’s food and agricultural challenge requires that the region integrates in and develops food and agricultural price chains[4]. In world price chains, price is added at each stage of the supply chain before crossing the border to be passed onto the next stage.[5] The IMF has found that the emergence of world price chains has allowed nations to better exploit their comparative advantages. Enhanced participation in world price chains has as well been associated with additional inclusive increase. But, according to the IMF, Sub-Saharan African nations generally find themselves at the start of the integration process into world price chains. Their exports tend to enter at the very beginning of world price chains, reflecting the still-predominant role of commodities in a lot of nations’ exports, and neither the complexity of Sub-Saharan African exports nor the quality of exported goods have been improving over the last two decades.Zooming in on food and agricultural price chains, these consist of the following universal major elements: input, production, processing, distribution and retailing (Figure 6).

Adding price throughout the price chain demands a holistic approach in which efficiency is improved at each step, and where the different elements in the price chain are linked and adapted to each other. In practice, this means that production can only be located where input is readily available or accessible; that the processor must have the end-consumer in mind; and that distribution and retailing must meet the challenges of the physical environment and of consumer preferences. For instance, at the same time as producing for local markets, formal companies must find ways to compete with informal suppliers. This is particularly the case in nations with a weak regulatory environment. They can do this by adding price to the end product through offering supply reliability or hygienic and quality controls for fresh produce. Box 1 provides an example of how regional differences – in this case between West and East Africa – influence opportunities for dairy price chain development. Producing for export markets poses from presently on further challenges: one must take account of export market developments, such as the increasing request for sustainably produced products and transparency about origin. Box 2 gives an impression of how such external developments challenge the organisation of the Ethiopian Arabica coffee price chain.

Box I: The sub-Saharan Africa Dairy value chain – a case study

As competition in the dairy sectors in Asia and Latin America continues to increase, and milk quotas in Europe have been abolished, growth in Africa is seen as the next big opportunity for the dairy sector.

1: Regional differences…

Consumer preferences, production possibilities and degrees of (in)formality throughout the dairy value chain differ widely across countries and regions. These differences are determined by such fundamental factors as natural endowments, degree of economic development and government intervention:

2. … mean different challenges in developing dairy business

As fundamental determinants of the value chain differ between countries and regions, so do investment needs, success factors and main challenges:

Box II: Ethiopian Coffee

Ethiopia is the number one coffee exporter in Africa. Its highlands provide good climatological and soil conditions for producing one of the finest Arabicas in the world. The country has much potential as a low-cost producer catering to the global speciality coffee market. Unfortunately, this potential is largely lost due to downstream hurdles in the coffee value chain. For instance, 80 per cent of the coffee exported by Ethiopia must pass through the Ethiopia Commodity Exchange (ECX) and cannot be traced to its origin, while demand for sustainability and origin continues to grow in Europe and the US. Sustainable and certified coffees command up to 30 per cent higher price levels and have experienced lower price volatility over the years. A revised regulatory framework which enables tracking and tracing upstream for speciality coffees and more efficient logistical processes could unlock new export growth.

The enabling environment for developing food and agricultural value chains differs largely across the region

What can be done to further Sub-Saharan Africa’s integration into global value chains and to develop regional value chains? Possibilities for doing so depend crucially on geography and the presence of an enabling environment.

Starting at the beginning of the value chain, the first determinant for food and agriculture production is climate and soil. Figure 7 presents the main agro-ecological zones for Africa with typical products that can be grown in each zone.

Next, conditions need to be in place to build on the climatological circumstances and to produce (or import) a crop, process it, and bring it to end-users. These enabling conditions for developing food and agriculture value chains have been identified to be as follows:

Each ‘enabling factor’ can be linked to one or more indicators so as to find a quantitative measure for countries’ levels of development in these areas. Annex I shows which indicators were used. Some indicators are illustrative of a country’s overall institutional development. Where possible, indicators specific for agriculture were used, such as in the case of agricultural loans, R&D and policy. Each country’s relative score on these indicators is used to calculate a composite Z-score for every individual country, which indicates the country’s readiness for food and agricultural value chain development[6].

Figure 9 ranks Sub-Saharan African countries on their Z-score for providing an enabling environment for food and agricultural value chain development. It is worth noting that out of the top ten performers, Botswana, South Africa, Mauritius, Seychelles, Namibia and Cape Verde also belong to the top ten of countries with the lowest agricultural value added as a percentage of GDP (see Figure 1 above), in other words: agriculture is not their core business. This suggests that as the economy develops and institutional quality improves, the economy moves away from agriculture, a hypothesis tested in Figure 10. At the same time, some countries which are known for attractive climatological conditions for agriculture (Zimbabwe) or large potential through undeveloped but fertile land (DRC) score low in terms of the enabling factors present for developing food and agriculture value chains.

- Related Articles

Top 10 Most Attractive Investment Destinations In Africa

2017/08/20 Africa’s feverish increase has decelerated in recent years and a lot of nations have buckled under the pressure of falling resource prices, security disruptions, fiscal imprudence and adverse weather conditions.

Africa's Relationship With China Is Ancient History

2017/07/02 In 2002 South Africa's Parliament unveiled a digital reproduction of a map - of China, the Middle East and Africa - that some speculated could be the initial map of the African continent. The Da Ming Hun Yi Tu - the Comprehensive Map of the Great Ming Empire - was drawn up around 1389 during the Ming Dynasty, according to historian Hyunhee Park.

Africa: Making Things Happen at the Bank - 'Not a Talk Shop' - Akin Adesina

2017/07/02 Dr. Akinwumi Adesina is focusing on five areas to achieve the African and world goals for a prosperous continent since becoming president of the African Development Bank - Africa's major public financial institution in September 2015. He was a keynote speaker at this month's Corporate Council on Africa's U.S.- Africa Business Summit in Washington D.C. and moderated a lively panel with five African government ministers. He as well received the Gene White Lifetime Succcess Award from the World Child Nutrition Foundation. This week, he was named the 2017 recipient of the World Food Prize, a prestigious honor that includes a $250,000 award. In an interview in Washington, DC, Adesina discussed the Development Bank's ambitious schedule and his vision for attracting the increase capital Africa needs. Posting questions for AllAfrica was Noluthando Crockett-Ntonga.

Climate change laws around the world

2017/05/14 There has been a 20-fold increase in the number of global climate change laws since 1997, according to the most comprehensive database of relevant policy and legislation. The database, produced by the Grantham Research Institute on Climate Change and the Environment and the Sabin Center on Climate Change Law, includes more than 1,200 relevant policies across 164 countries, which account for 95% of global greenhouse gas emissions.

Japan aims to increase Africa’s power generation capacity by 2,000 megawatts

2017/04/19 Between 2016 and 2018, Japan has pledged to invest $30 billion in Africa’s development, as it bids to join the likes of China and the US in the battle for influence on the continent. Competition in Africa is heating up, with Japan aiming to increase its presence and influence on the continent as it looks to make up ground lost to China since the turn of the century. Japan launched the Tokyo International Conference on African Improvment(TICAD) back in 1993, and since again has invested around $50 billion in Africa, a meagre sum at the same time as compared to China and the US.

- Southern Africa News

-

- SOUTH AFRICA: KPMG's South Africa bosses purged over Gupta scandal

- SOUTH AFRICA: Zimbabwe Election Commission keen to avoid Kenyan situation

- KENYA: Kenya, Nigeria & S. Africa: biggest winners of Google's Africa tech training

- ANGOLA: Submarine cable deployed in Angola to link Africa to South America

- AFGHANISTAN: UNWTO: International tourism – strongest half-year results since 2010

- BOTSWANA: Why governments need to support the financial sector to meet the unserved needs of smallholder farmers

- Trending Articles

-

- SOUTH AFRICA: Nigeria and South Africa emerge from recession

- BAHRAIN: Bahrain issues new rules to encourage fintech growth

- UZBEKISTAN: Former deputy PM named Uzbekistan Airways head

- ARUBA: Director of Tourism Turks and Caicos after Irma: Tourism, visitors, hotels current status

- ANGOLA: Angola: Elections / 2017 - Provisional Data Point Out Qualified Majority for MPLA

- WORLD: How fair is our food? Big companies take reins on sourcing schemes