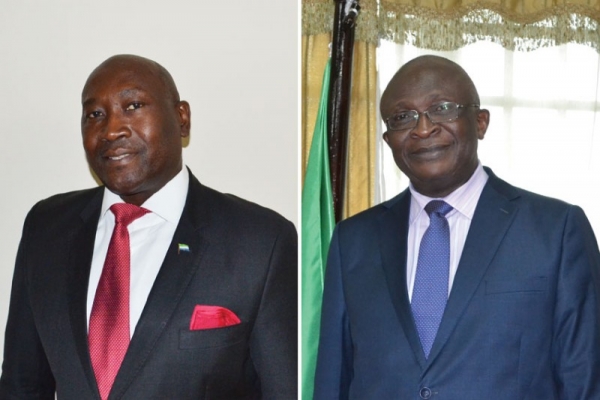

Sierra Leone: Henry O. Macauley, Minister of Energy. Right: Momodu L. Kargbo, Minister of Finance and Economic Development

2017/06/19

Sound macroeconomic policies together with generous support from development partners has helped ensure fiscal and external sustainability following the devastation caused by the Ebola crisis and a drop in iron ore prices

Until the outbreak of Ebola in May 2014, Sierra Leone – a country again still emerging from the devastating legacy of conflict – was seeking to become a transformed country with middle-gain status. However, at the same time as West Africa was struck by the deadly epidemic, a disease that ended up killing thousands of people in the region, no other country suffered the shattering socio-economic consequences additional deeply than Sierra Leone.

The epidemic strained by presently fragile public finances, and its direct and indirect impacts resulted in the destruction of some of the country’s post-civil war evolution in human development. Schools were closed for eight months and public gatherings banned. At the same time as the crisis in the country was declared over in November 2015, Sierra Leone’s President Ernest Bai Koroma, a man who won a second and final term as leader in November 2012 and whose time in office prior to the Ebola outbreak was characterised by record economic increase, talked of the “devastating result on the economy”. But in March 2016, the country was officially declared Ebola-free.

Ebola wasn’t the only shock that the country had approaching to terms with recently either. In the midst of the outbreak, adverse world developments as well affected Sierra Leone’s biggest economic sector: mining. Between 2014 and 2015, world iron ore prices declined by additional than 60 %, contributing to the eventual closure of the mines that account for one quarter of Sierra Leone’s GDP and half of its exports. Combined with the Ebola virus epidemic, these developments contributed to an estimated 20.5 % contraction of the economy in 2015.

However, all is by no means lost, and amid the adversity, a new window of opportunity to rebuild the economy has arisen. Buoyed by the aid of international donors, the government has taken full chance by making concrete plans, as outlined in its Economic Recovery Strategy (ERS).

At the conclusion of an International Monetary Fund (IMF) mission to Sierra Leone in September, mission chief John Wakeman-Linn hailed the government reforms so far under the strategy as “largely successful”.

“The economy proved resilient in the face of two major exogenous shocks: the Ebola epidemic and collapse of iron ore prices,” he summarised. “Sound macroeconomic policies, together with generous support from development partners helped ensure fiscal and external sustainability, while providing sufficient resources to begin implementing the post-Ebola Recovery Strategy. Since the last quarter of 2015, economic increase has resumed, and it remains on an upward trend.”

Indeed such is the upward trend that the government estimates a GDP increase of 4.9 % last year, rising to 5.4 % in 2017, 5.8 % in 2018 and 6.1 % in 2019, with increase mainly driven by anticipated escalation in iron ore production, agriculture, fisheries, tourism, construction, manufacturing and energy.

As Sierra Leone’s Minister of Finance and Economic Development Momodu L. Kargbo explains, the impressive pace of the recovery owes to the fast and decisive action that the government took in the wake of the crisis.

“Since the moment that Ebola was waning, our government started to plan the recovery and developed the National Ebola Recovery Strategy,” he says. “The initial phase focused on the immediate recovery priorities in agriculture, health, education, private sector recovery and water and sanitation.

“To allow farmers to return to their farms, this government, supported by our development partners, provided them with agricultural inputs such as seeds, fertilizers and tools. We re-opened schools and restored general health services. The government as well expanded its social safety net programmes, inclunding cash transfers to the hardest hit to avoid longer-term economic hardship.

“We encouraged the swift resumption of infrastructure projects that were halted due to Ebola, providing jobs and gain together with investment activities which resulted in the resumption of export of iron ore from the major mine.”

The second set of efforts, says Minister Kargbo, was focused on energy and water supply. “Our government provided fiscal support to the energy sector to complement the Bumbuna hydro dam, which increased the available energy and facilitated the increase of manufacturing and commerce,” recalls the finance minister. “We as well continued the implementation of sound economic policies and public financial management reforms under the Extended Credit Facility supported by the IMF.”

Aside from the key macroeconomic policies that have seen Sierra Leone undergo this remarkable rise from the ashes (policies that the Bank of Sierra Leone has been instrumental in implementing), the country’s ongoing recovery can as well be put down to something rather additional simplistic, according to the central bank’s governor, Dr Kaifala Marah: inherent national resilience.

“We’ve bounced back each time we were confronted with a challenge: that is what characterises and defines us as a country,” says the governor. Indeed it was only 14 years ago that Sierra Leone had to pick itself up next a long and brutal civil war that ravaged the country and its infrastructure, but just as it is doing presently in the aftermath of Ebola, the country somehow managed to doggedly get back on its feet.

“Following the war, we were clear in the goals we wanted to achieve by following President Koroma’s Schedule For Prosperity,” says Dr Marah. “We improved our infrastructures, the available electricity multiplied, the GDP was growing faster each year. However, Ebola came and we experienced a dramatic drop of 20.5 % in our economy. We are just presently being able to recover, and that says a lot about our resilience.”

Today, Dr Marah explains, Sierra Leone’s recovery is being consolidated through the government’s policies, of which attracting better foreign direct investment (FDI) to achieve better economic diversification is absolutely fundamental.

“The key element that will push our macroeconomic clearance efforts is to find a way to get as much investment as possible into the country,” stresses the governor. “For that, we need to ensure a stable economic situation, which involves different targets: initial of all, we need to keep inflation low. We as well need a stable exchange rate, that we will achieve once the commodity prices rise again. Once we achieve all the macroeconomic fundamental goals, foreign investors will come by their thousands,” he adds confidently.

“Our economy is presently under austerity measures, meaning we need to be additional prudent and expend our resources additional wisely,” says Henry O. Macauley, Minister of Energy. “The only way we can get our economy[of austerity] is by increasing consumer confidence and make our people spend their money. For that, products must be affordable. How do you make products affordable? If the cost of the product is sufficiently low to make the price competitive.”

The IMF has pointed out that, going forward, the government recognises that macroeconomic policies alone will not create the jobs needed to achieve durable economic evolution.

“As such, the immediate focus of the ERS on health, education, and social safety nets should help improve human development and labour productivity in Sierra Leone,” says Iyabo Masha, the IMF’s Resident Representative to Sierra Leone.

“Medium-term Economic Recovery Strategy plans, together with the longer-term Schedule for Prosperity could drive investment and employment creation. With improvements in labour productivity, private sector investment and infrastructure upgrade, new sources of increase would complement recovery efforts. Sierra Leone could therefore evolution towards its goal of becoming a middle-gain country by 2035.”

Some sectors of the economy inclunding agriculture, fishery, tourism and port services are by presently well placed to drive the next era of increase, with the agriculture sector in particular poised to benefit from ongoing and planned reforms, adds Ms Masha.

“The focus on niche tourism as enunciated in the government’s tourism recovery plan could as well put Sierra Leone on the international map while generating substantial foreign investment and employment.”

- Related Articles

-

Africa’s economic growth in 2016 was driven by East Africa

2017/08/20 While the continent’s major economies were hit by the fall in commodity prices in 2016, Africa retained its position as the second-fastest growing continent globally recording an average of 2.2% GDP increase, behind only South Asia, according to the African Development Bank Group (AfDB). Much of Africa’s increase in 2016, AfDB says, was driven by East Africa where several nations recorded “strong performances.” In general, of the continent’s sub-regions, East Africa posted the highest increase rate with 5.3%, led by Ethiopia. -

Africa property offers rich pickings for the brave

2017/08/20 Some property pundits believe there are major opportunities for investors or companies on the continent. While most pundits will acknowledge that the saying “Africa is not for sissies” rings authentic at the same time as it comes to property investment , some commentators believe that there are major opportunities for investors on the continent. -

How Can Sierra Leone Learn From Mudslide to Avert Future Deaths?

2017/08/18 "Freetown and other precarious cities need safer urban planning and land use initiatives" A mudslide which devastated Sierra Leone's capital Freetown this week, killing about 400 people and leaving more than 3,000 homeless, has raised questions about deforestation, urban planning and disaster preparedness in the West African nation. The Thomson Reuters Foundation asked aid organisations, land rights activists and researchers what lessons Sierra Leone can learn from the mudslide to avert such crises in the future. -

Sierra Leone: At Least 105 Children Among Mudslide Deaths

2017/08/18 Sierra Leone's government has declared seven days of mourning for victims of Monday's deadly flooding and mudslide tragedy. The country's national flag will fly at half-mast from today to Tuesday (Aug 16 - 22), the government said in a statement in which it as well called for a minute of silence at midday on Wednesday in honour of the 300 people who died in the capital Freetown. According to government figures, the death toll stands at 297 and includes 109 children, 83 women and 105 men. Data deputy minister Cornelius Deveaux said the figure is based on a body count at the city's major morgue at Connaught hospital. -

Sierra Leone, where officials say at least 300 people have died

2017/08/15 UN Secretary-General Antonio Guterres was "saddened" on Monday by the mudslide and flooding in and near Freetown, Sierra Leone, where officials say at least 300 people have died and at least 2,000 people left homeless. "The Secretary-General is saddened by the deaths and devastation caused by the mudslide and flooding in the town of Regent, Sierra Leone, and throughout Freetown," the capital, said Farhan Haq, Guterres' deputy spokesman. "The Secretary-General extends his condolences to the people and Government of Sierra Leone for the loss of life and destruction caused by this natural disaster."

-

- Sierra Leone News

-

- BOTSWANA: Africa’s economic growth in 2016 was driven by East Africa

- BOTSWANA: Africa property offers rich pickings for the brave

- SIERRA LEONE: How Can Sierra Leone Learn From Mudslide to Avert Future Deaths?

- SIERRA LEONE: Sierra Leone Declares Seven-Day Mourning After Mudslide Tragedy

- SIERRA LEONE: "Deaths and devastation" in Sierra Leone mudslide saddens UN chief

- BOTSWANA: Bill Gates sees US likely to maintain aid levels for Africa

- Trending Articles

-

- QATAR: Qatar Airways transit business in jeopardy

- EGYPT: Egypt foreign reserves at highest since 2011 uprising

- QATAR: Qatar plans to boost gas production by 30%

- EGYPT: Egypt announces new sharp increase in fuel prices

- MOROCCO: Morocco delays currency reform amid speculation

- SAUDI ARABIA: Saudi stock market bullish on new heir

.gif?1356023993)

.gif2_.gif?1356029657)