Africa: Yes, Africa will feed itself within the next 15 years

2016/01/08

Africa will be able to feed itself in the next 15 years. That’s one of the large “bets on the next” that Bill and Melinda Gates have made in their foundation’s new annual letter. Helped by other breakthroughs in health, mobile banking and education, they argue that the lives of people in poor nations “will improve faster in the next 15 years than at any other time in history”.

Their “bet” is good news for African agriculture: agronomy and its natural twin, agricultural extension, are back on the schedule. If Africa is to feed itself, the women and men who grow its crops need access to technical expertise on how to manage their variable natural resources and limited inputs and market intelligence on what to grow, what to sell and what to keep.

New tools in the hands of farmers

The Gates foundation statement outlines that African nations spend $50 billion a year importing food. Nigeria alone imports $500m of rice from Vietnam each year.

But there is no quick fix that will transform African agriculture without skillful agronomy and intelligent extension. Whatever the promises brought by new, drought-tolerant varieties of crops such as maize, they cannot achieve their potential without the wise management of fertilisers, timing of cultivations and appropriate crop rotations.

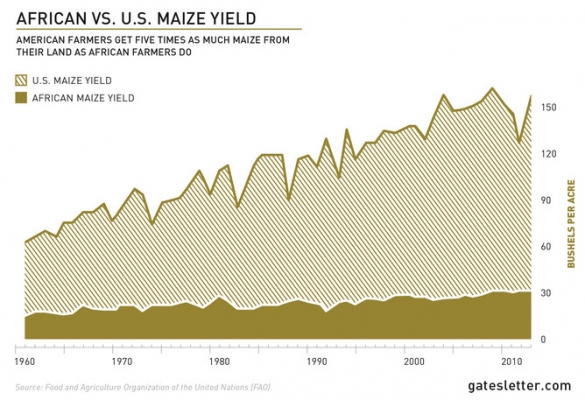

As the graph above shows, sub-Saharan Africa’s crop yields remain very low compared to the rest of the world. Sadly, in our rush for only genetic solutions to increasing agricultural yields, we have ignored the fields and landscapes in which crops are grown. The consequence has been a missing generation of scientifically trained agronomists and agricultural extension workers – who help teach farmers about new farming practices – with the skill sets required to manage resources and apply principles.

Meanwhile, powerful tools such as geospatial mapping, predictive modelling, remote-sensing (using aerial imaging to assess the national of vegetation) and mobile technologies have advanced to a stage where they are of practical use to the scientific agronomist, educated extensionist and literate farmer. We presently have a real opportunity to link genetic advances and improved management with the social and economic drivers for African agriculture. This “research price chain” between grower and consumer requires that each research discipline plays an interconnected role with the end-user always in sharp focus.

Soils and sustainability

So, what are the priorities for African agriculture in the next 15 years? Initial, we must rehabilitate its soils. Since 2015 has been declared as the UN International Year of Soil, we need to recognise that Africa has some of the world’s frailest soils, which have suffered most from “cereal abuse” through the almost continuous cultivation of cereal crops. These monocultures have left Africa’s soils tired and impoverished. Applications of fertilisers will not, by themselves, be enough to save them.

For sustainable agricultural systems, we need to reconsider our addiction to major cereals grown as monocultures and move from “calorie security” to “nutritional security”. For this, nitrogen-fixing leguminous crops have to be part of any solution. In his Noble Peace Prize address in 1970, Norman Borlaug, the father of what became known as the “green revolution” in South Asia, recognised the imbalance between research advances on the major cereals and those on all other crops:

The only crops which have been appreciably affected up to the present time are wheat, rice, and maize… nor has there been any appreciable increase in yield or production of the pulse or legume crops, which are essential in the diets of cereal-consuming populations.

Approaching 50 years later, the situation remains similar. Clearly, improvements in leguminous crops (such as beans and lentils), both in their own right as nutritious sources of food and as rehabilitators of soil, are long overdue. Since 2016 has been declared as the UN International Year of Pulses, there is no better opportunity to redress the historical imbalance noted by Borlaug.

Crops for the future

We as well need to recognise that most African family farmers are women. Often the species they cultivate are not the major cash crops grown by men as mechanised monocultures. Rather, they are local “underutilised” species, often legumes and vegetables, which families cultivate in complex landscapes for their own sustenance.

These crops, and the multiple cropping systems which support them, have few influential champions and rarely feature in the research strategies of national and international agencies. But it is crops and agricultural systems such as these that will help Africa feed itself sustainably.

In a very real sense, these “crops for the next” will help diversify Africa’s agriculture to meet the volatile physical and economic climates that lie ahead. Unlike the major crops which have received billions of dollars of support over generations, underutilised crops deserve a “large bet” over the next 15 years if they are to help achieve major breakthroughs for most people in most poor nations.

- Related Articles

-

French manufacturers in Morocco Factories in the sun

2016/06/21 CONSIDERING the help provided to large foreign manufacturers in Morocco over the completed few years, it would have taken a critical effort by them to fail. Renault, a French carmaker, for example, is thriving: of 2.8m cars it made globally last year, one in ten trundled out from its two shiny assembly plants in Tangier and Casablanca. It hopes from presently on to make 400,000 cars a year. -

South Africa to extend ICT reach

2016/06/19 While the expansion of mobile broadband and fibre-optic networks are driving increase of ICT services in South Africa, additional infrastructure investment will be needed to keep pace with rapidly rising market request. Focus on speed South Africa has a set of ambitious targets laid out in its national broadband policy, South Africa Connect, which includes achieving 50% internet coverage with speeds of 5 Mbps by 2016; roughly 90% coverage at the same speeds by 2020; 50% coverage with speeds of 100 Mbps by 2020; and universal 100-Mbps coverage by 2030. -

Kenya’s tea industry moves toward strategic diversification

2016/06/19 Reducing a reliance on bulk black tea is a key objective for Kenya as it looks to boost revenue from one of its flagship agricultural sectors. Kenya is the world’s leading exporter of black tea, which accounts for 95% of the country’s in general tea production, making it one of its major agricultural exports. Tea exports generated earnings of KSh125.3bn ($1.23bn) in 2015, a 23% increase from the previous year. The jump in revenue was the result of higher prices due in large part to a weaker harvest, with 2015 crop yields at 399.2m kg, a 10% year-on-year decrease, according to data from the Agriculture, Fisheries and Food Authority (AFFA). Prospects for 2016 are somewhat additional muted, with overseas tea sales predicted to generate between KSh115bn ($1.14bn) and KSh120bn ($1.19bn). -

Ghana steps up to secure electricity supply

2016/06/19 The start of new gas production in Ghana has significantly improved the prospects for long-term increase in the country, although efforts to exploit domestic reserves for local power generation faced a minor setback before this year. While Ghana’s hydrocarbons sector has seen relatively stable output over the initial few months of 2016, a two-week period of inspection and maintenance work on the Kwame Nkrumah, a floating production, storage and offloading (FPSO) vessel, led to a temporary drop in gas supply to the power sector. The shutdown slowed gas supply to the Volta River Authority’s (VRA) thermal generating facilities in Aboadze, reducing output by 250 MW, according to local media. -

Tunisia augments ICT exports and connectivity

2016/06/19 A strategic five-year plan targeting Tunisia’s ICT sector, Tunisie Digitale 2020, looks to dramatically increase the industry’s contribution to employment and revenues. First launched in 2014 as Tunisie Digitale 2018, the plan was revised last year to harmonise its timelines and objectives with the government’s new five-year general economic development plan for the 2016-20 period. The plan aims to create 100,000 jobs and double the GDP of the country’s digital economy to TD9bn (€4.1bn) by 2020. Sector exports, meanwhile, are expected to increase four-fold between 2014 and 2020 to TD4bn (€1.7bn).

-

- Africa News

-

- CASABLANCA: Factories in the sun European firms bring carmaking and an aerospace industry to north Africa

- SOUTH AFRICA: South Africa to extend ICT reach

- KENYA: Kenya's tea industry moves toward strategic diversification

- GHANA: Ghana steps up to secure electricity supply

- TUNISIA: Tunisia augments ICT exports and connectivity

- DJIBOUTI CITY: Djibouti takes steps to overhaul banking sector

- Trending Articles

-

- KENYA: Kenya's tea industry moves toward strategic diversification

- CHINA: Forty-six Chinese-owned companies registered in Guinea-Bissau

- GHANA: Ghana steps up to secure electricity supply

- TUNISIA: Tunisia augments ICT exports and connectivity

- INDIA: Indian central bank chief to step down in surprise move

- NIGERIA: Nigeria’s e-commerce industry shows growth potential

.gif?1356023993)

.gif2_.gif?1356029657)