Rwanda: Rwanda Communication Sector Profile

2013/08/17

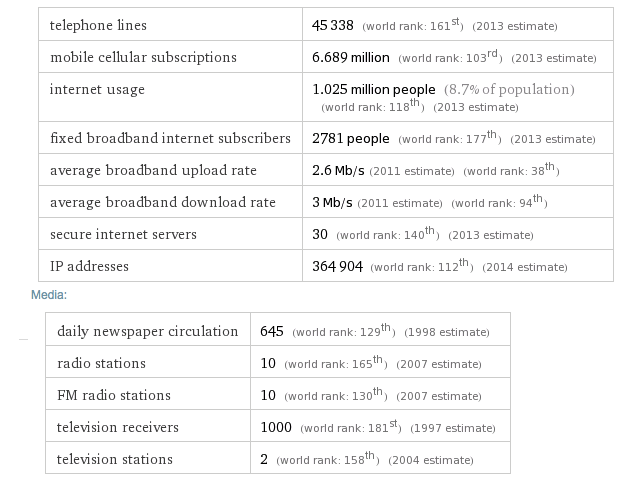

The Rwandan telecom sector has shown particularly strong increase in recent years, buttressed by a vibrant economy and a GDP which has sustained increase of between 7% and 8% annually since 2008. As a result, the country is rapidly catching up with other markets in Africa, with increased penetration particularly evident in the internet and mobile sectors.

Although the country was slow to liberalise the mobile sector, allowing South Africa’s MTN a monopoly until 2006 at the same time as the fixed-line incumbent, Rwandatel became the second mobile operator, there is effective competition part the three current operators, each of which provides wide geographic coverage. The launch of services from Millicom/Tigo in 2009 sparked renewed subscriber increase, though competition has eroded mobile services revenue and ARPU since again.

Rwanda’s internet and broadband sector has suffered from limited fixed-line infrastructure and high prices, but developments in the fixed network market are improving connectivity and reliability. The operators are rolling out national fibre-optic backbone networks which as well allow them to connect to the international submarine fibre-optic cables that landed on the African east coast in 2009 and 2010. These cables have given all region fibre-based international bandwidth for the initial time and brought to an end its dependency on satellites.

Interest from investors in the country’s ICT sector remains strong, particularly during the last few years. An existing transaction with Korea Telecom to build a national fibre backbone was supplemented in September 2013 with a transaction by which Korea Telecom will build a national LTE network, for which it has secured spectrum and an exclusive licence to operate the network for 25 years.

This statement contains an overview and analysis of Rwanda’s telecommunications market, profiles of the major players in all market sectors, relevant statistics and analysis, and scenario forecasts to 2013 and 2016 for the country’s mobile market.

Key developments:

Rwanda Olleh Networks close to opening network for LTE services; Liquid Telecom completes the East Africa Fibre Ring; Airtel launches Airtel Zone; Northern Corridor plan roaming agreement by en-2014; government increases telecom tax to 10%; government services to be available online from early 2015; additional mobile network operator enters the market; Tigo launches cross-border money transfer service for Tigo Pesa users in Tanzania and Rwanda to send and receive funds; JV created with Korea Telecom to build a national LTE network; strong mobile subscriber increase continuing; mobile market forecasts to 2016; MTN Group sells tower network to IHS Holding (IHS); Liquid Telecom takes over from the failed Rwandatel; regulator’s market data to July 2014; market developments into 2014.

Estimated market penetration rates in Rwanda’s telecoms sector – March 2014

| Market | Penetration rate |

|---|---|

| Mobile | 65% |

| Fixed | 0.44% |

| Internet | 22.0% |

(Source: BuddeComm based on various sources)

.rw

- Rwanda News

-

- AFGHANISTAN: UNWTO: International tourism – strongest half-year results since 2010

- BOTSWANA: Why governments need to support the financial sector to meet the unserved needs of smallholder farmers

- BOTSWANA: International Arrivals To Africa Reach More Than 18 Million In 2017

- RWANDA: Rwanda police rearrests female critic of Kagame, her mom and sister

- RWANDA: Rwandan police arrest Diane Rwigara, family members

- BOTSWANA: Africa: USA-Africa - No Policy? Bad Policy? or Both?

- Trending Articles

-

- NIGERIA: The Security and Exchange Commission approves the 40th Annual General Meeting of Oando PLC

- NIGERIA: Dangote signs $450million jumbo sugar production agreement with Niger state

- KENYA: Kenya poll rerun: Uhuru on campaign trail, Raila seeks campaign funding

- UNITED STATES: Mandatory evacuation order in Florida

- AFGHANISTAN: UNWTO: International tourism – strongest half-year results since 2010

- NIGERIA: Nigeria has been one of the hardest-hit economies due to its over-dependence on oil