Russia: Russia overcomes emerging market jitters

2013/11/15

The Russian sovereign dispensed with a pre-transaction roadshow for the initial time to speed up the issuance process during heightened market uncertainty and still managed a heavily oversubscribed transaction that included a debut euro tranche.

The middle of 2013 was a difficult time for emerging markets. Expectations that the US Federal Reserve was about to taper its bond-buying programme sent deficit prices lower across the emerging market spectrum. New issuance dried up and at the same time as issuers did come to market, they were forced to pay a hefty premium.

This was hardly the majority auspicious backdrop for Russia, which has a tradition of tapping the bond market in size once a year and had indicated that it was looking to issue a multi-billion-dollar transaction in the second half of 2013.

“We started thinking about the issue at the beginning of the year and finalised all the necessary internal procedures by early summer. However, due to the tough macro environment, the decision to issue had to be based on market conditions. We constantly monitored the market looking for the right window to start execution,” says Konstantin Vyshkovskiy, the director of national deficit and financial assets at the Russian finance ministry.

August was particularly challenging, however. Not only did Russia have to contend with rising US Treasury yields, but investors were as well unnerved by events in Syria and the Russian connection to the country's president, Bashar al-Assad.

Euro debut

By September, markets were a little calmer. Russia’s lead managers were domestic banks Gazprombank, Renaissance Capital and VTB Capital, alongside Barclays, Deutsche Bank and Royal Bank of Scotland. The group advocated issuance early in September, at the same time as investors were fresh from the summer break and request for new paper was likely to be relatively robust. The sovereign was looking to raise about $7bn equivalent, inclunding a debut euro tranche. “We intended to issue a euro-denominated tranche in order to diversify our investor base and start building an indicative euro yield curve,” says Mr Vyshkovskiy.

Given market volatility, the finance ministry decided to dispense with a roadshow, so as to maximise its flexibility. On Friday, September 6, US non-farm payroll figures gave markets a small boost, and over the weekend Russia and its banks plotted a Monday launch.

“Our principal objective was to minimise risks and achieve smooth intraday execution amid a period of heightened volatility and political uncertainty surrounding Syria,” says Mr Vyshkovskiy.

“We as well took into account data about other potential sovereign and corporate issuers that were going approaching to market in the same week. One of our major strategic objectives was to establish a clear benchmark transaction for other Russian issuers and maintain a liquid sovereign curve. As such, we were looking approaching to market as early as possible following the quiet summer period in August,” he adds.

Heavy demand

The transaction was launched at 10.30am London time and within two hours the order book had reached additional than $11bn equivalent. Initially configured as a five-tranche issue – five, 10 and 30 years in US dollars and seven and 12 years in euros – the 12-year euro tranche was again ditched because request for the dollar paper was so strong. The maximum all was set at $7bn, pricing was tightened by 17.5 basis points on the dollar tranches and the orders continued to pile in, reaching additional than $16bn equivalent across all tranches. From presently on, the sovereign raised $1.5bn for five years, $3bn for 10 years, an extra $1.5bn for 30 years and €750m for seven years.

A lot of observers were impressed by Russia’s ability to obtain 30-year money at a time at the same time as the Fed had still not clarified its stance on tapering and a degree of uncertainty permeated markets. The long tenor of this tranche was said to highlight Russia’s premium position in the emerging market stable. For the sovereign itself, however, tapping the market without talking to investors initial and successfully raising euro capital were particularly satisfying.

“The majority precious experience we gained from this issue was transaction execution without a roadshow in order to fit in the narrow market window. At the same time, the experience of issuing a euro-denominated Eurobond for the initial time cannot be underestimated,” says Mr Vyshkovskiy.

Russia will not be returning to the market this year, although its transaction paved the way for issuance from other emerging market sovereigns and a number of Russian banks. Over the next three years, however, the Russians expect to tap investors for further multi-billion-dollar fund-raisings. Given the success of the recent issue, next transactions may well be structured along similar lines.

“Our next funding plans will be defined by Russian budget law, which is to be adopted by the end of the year, but preliminary data suggest the equivalent of $7bn per annum for the next three-year period. We are open to consider borrowing in alternative currencies, such as euros, should it prove beneficial for us or for other Russian issuers, but our key focus remains on the US dollar market,” says Mr Vyshkovskiy.

- Related Articles

Europe needs a restart and reboot.

2015/08/27 EU bank regulation should be applied consistently on a proportionate basis that reflects the size and business model of the banks being regulated. Europe needs a restart and reboot. This as well means a additional reasonable approach in the production of rules for the banking sector. In early July, the European Banking Authority (EBA) published a few hundred pages of new technical standards and guidelines on the bank recovery and resolution directive. Introducing the concepts of recovery/resolution planning, bail-in and orderly failure into a lot of member states’ legal systems for the initial time, the directive applies to all kinds of banks in the EU.

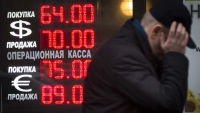

Russia faces 5% contraction, development bank predicts

2015/01/21 Russia’s economy will shrink by close to 5 % this year, the European Bank for Reconstruction and Development has said in its new estimate, while average increase for eastern Europe and the former Soviet Union will fall into negative territory for the initial time since 2009. The development bank for the former communist bloc said plunging oil prices and western sanctions would lead to a contraction in Russia of 4.8 % this year, compared with its September estimate of a 0.2 % drop.

Leaders of the Group of 20 conference in Russia

2013/09/05 Leaders of the Group of 20 conference in Russia will consider endorsing a strategy for long-term economic increase that emphasizes steps such as infrastructure spending and job training.

G20 gets 'action plan' to fight tax avoidance

2013/07/22 The OECD has presented the G20 nations with a bold strategy to crack down on tax avoidance by corporate giants and the superrich, and so boost overstretched national budgets. The G20 group of emerging and advanced nations -- inclunding the US, EU, China and Russia -- had asked the Organisation for Economic Cooperation and Improvment(OECD) approaching up with the action plan next agreeing before this year to focus on tax avoidance. The OECD said Friday that governments had to better align tax regulations to prevent large investors from parking huge sums in tax havens.

Abdurakhman Zulumkhanov – Dudu Communication’s Project Manager

2013/02/09 Founded in 2007, DUDU Communications is a team of professionals from Russia, Turkey, the UAE, Germany and several other nations. In April 2011, the company launched Godudu, world’s prime multilingual social network that is unique in offering simultaneous translation from one language to an extra.

- Russia News

-

- GERMANY: Russia-Ukraine Conflict: Germany Says EU Sanctions Against Kremlin Could Be Lifted

- GREECE: Russian Tourists Flock To Greece After Turkey, Egypt Bans

- NORTH KOREA: North Korea detains Russian yacht in neutral waters

- CASABLANCA: Morocco wants more Russian tourists

- RUSSIA: Morocco, Russia Set to Promote Trade

- RUSSIA: Russia's Aeroflot launches updated investor relations website

- Trending Articles

-

- AUSTRALIA: Australia taxes foreign home buyers as affordability bites

- SERBIA: China’s Xi sees Serbia as milestone on new ‘Silk Road’

- CHINA: United States sees China investment talks ‘productive’ after new offers

- INDIA: Indian central bank chief to step down in surprise move

- THAILAND: Foreign investment plummets in junta ruled Thailand

- UNITED STATES: Trump says Britain should leave EU