Israel: Israel Economy Profile

2015/08/02

Israel has a technologically advanced market economy with substantial, though diminishing, government participation. It depends on imports of crude oil, grains, raw materials, and military equipment.

Despite limited natural resources, Israel has intensively developed its agricultural and industrial sectors over the past 20 years. Israel imports substantial quantities of grain but is largely self-sufficient in other agricultural products. Cut diamonds, high-technology equipment, and agricultural products (fruits and vegetables) are the leading exports. Israel usually posts sizable trade deficits, which are covered by large transfer payments from abroad and by foreign loans. Roughly half of the government's external debt is owed to the US, its major source of economic and military aid.

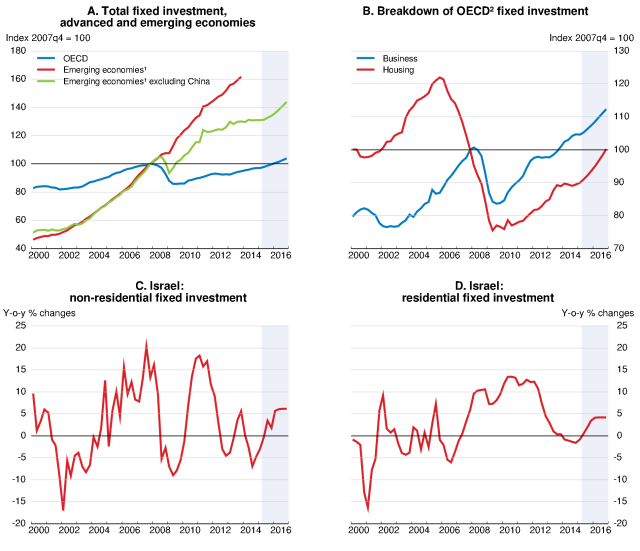

Economic growth slowed in 2014, picked up strongly at the end of the year and should strengthen to around 3.5% in 2015 and 2016, helping to keep unemployment low. Lower oil prices, further cuts in interest rates and a significant revaluation of the minimum wage should shore up domestic demand, while the gradual improvement of the global economy boosts exports.

An accommodative monetary policy is still appropriate to support current growth and prevent undesirable appreciation of the shekel. But the likely temporary nature of the price falls in early 2015 argues against further relaxation involving unconventional measures. The public debt reduction policy is still needed to increase the room for fiscal manoeuvre, but it must draw more on revenue increases, and the current rule constraining spending should be reviewed. Structural reforms are also crucial to enhance competition on product markets and formal education and skills, especially among the Ultra-Orthodox and Arab populations, to stimulate productivity and to make growth more inclusive.

Increased investment in infrastructure – especially public transport and the natural gas distribution network, but also education – is needed to lift some of the barriers to private investment and boost potential growth. The government should pursue efforts to improve the co-ordination of public intervention in the property sector to better respond to housing demand by increasing supply and thus reducing prices.

Industry

Today's dynamic, widely diversified industrial sector developed from workshops originally set up a century ago to manufacture farm implements and process agricultural products. An incentive to local industry occurred during World War II (1939-45) when the Allied forces in the region required various commodities, especially clothing and canned foods. However, modern industry attained significant development only in the early 1960s, as in the 1950s most resources were directed towards developing agriculture and the national infrastructure.

In view of the country's highly qualified labor force and a lack of raw materials, industry now concentrates mostly on manufactured products with high added values, by developing products based on Israel's own scientific creativity and technological innovation. Until the 1970s, traditional branches - such as food processing, textiles and fashion, furniture, fertilizers, pesticides, pharmaceuticals, chemicals, rubber, plastic and metal products - provided most of the country's industrial output.

Unlike most developed economies, in which the number of persons employed in industry remained stable or diminished during the early 1990s, their number in Israel continued to grow - and by 1996 there were 26 % additional than at the beginning of that decade, though the number has not risen further since then. Israel's industrial increase rate, 51.3 % during 1990-96, was the second highest part the developed economies (after Korea).

In the past decades, industrial output has made international-level strides in the fields of medical electronics, agrotechnology, telecommunications, fine chemicals, computer hardware and software, and diamond cutting and polishing. In 2000 there were some 15,400 industrial firms employing 363,000 persons (14 % of them with higher education, a rate second only in the workforces of the US and Holland) that produced an output of around $50 billion - additional than half of which was exported.The economic slow-down in Israel, coupled with the worldwide crisis in the high-tech industries, affected the local manufacturing industry considerably. Its product fell in 2001 by 5.7 % (as against a 10 % leap in 2000); the number of firms and employees decreased to 14,000 and 351,000, respectively. Investments declined by 17 % (after a rise of 6.5 % in 2000) thus falling by over 40 % in year, from $6.9 billion in 2000 to $4.1 billion in 2001.

High-Tech Industry

The fastest increase rates are to be found in the high-tech sectors, which are skill and capital intensive and require sophisticated production techniques inclunding considerable investment in R&D (the quality of which is ranked, according to the U.N. experts, part the highest in the world). A successful contribution to both these requirements is available thanks to academic research institutes, which provide much of the basic R&D, and venture capital funds, the number of which has grown from to sixty since 1993. In 2000 they administered over $4 billion invested in some 160 start-ups.

National spending on civilian R&D exceeded $4.8 billion in 2001 (similar to the 2000 figure) and double the sum allocated in 1991. The economy's investment in venture capital funds amounts to approximately 3 % of its GDP (compared to only 0.3 % in an advanced economy like the United States).

The significance of high-tech firms may be illustrated by the following: whereas they accounted for only 37 % of the industrial product in 1965 and for 58 % in 1985, they now exceed thirds of it. Three quarters of the high-tech product are exported (providing some 80 % of industrial exports excluding diamonds) while the additional traditional, low-tech firms export only close to 39 % of their product. High-tech exports quadrupled from $3 billion in 1991 to $12.3 billion in 2000; however, their remarkable 69 % jump during 2000 was followed by a 12.6 % fall, to $11 billion in 2001.

Over 90 % of the annual $1.4 billion public budgets for R&D are allocated to the high-tech industries, much of which is channeled via joint venture capital funds. In recent years, the government has been collecting fair dividends on its shares in these funds, over and above repayment of loans granted to successful start-up companies.

The age of data technology (the Internet, electronic commerce, etc.) placed Israel's economy, and particularly its high-tech industries, in the forefront of world development in these fields. A number of internationally recognized Israeli companies have been bought by top business conglomerates in multi-billion dollar transactions.

The number of new start-ups is very high (additional than 4000 at the beginning of the new millennium) due to the extraordinary innovation talents in Israel, coupled with the availability of highly skilled manpower. In some industries (hardware inclunding software) this increase rate was, until 2001, even higher than in the Californian Silicon Valley, with foreign investors pouring some $6 billion into the industry during 1998-99. The growing presence of Israeli firms on Wall Street and the European Stock Exchanges is from now on another manifestation of the respect with which Israel's high-tech industry is regarded.

Israel now operates bi-national funds for cooperation in funding industrial R&D: with the US (BIRD); with Canada (CIIRDF); with Singapore (SIIRD); and with Britain (BRITECH). In addition, it has agreements for joint funding of R&D projects with Austria, France, Germany, Holland, Ireland, Portugal and Spain.

Israel's Diamond Industry exports amounted to $7.51 billion in 2001, producing about 80 % of the world output of small polished stones, which comprise most of the gems used in jewelry settings. It is as well responsible for 40 % of the polishing of diamonds of amount sizes and shapes, making Israel the world's leading diamond-polishing center in terms of both production and marketing.

Construction

In the early years of the national, residential building accounted for 84 % of total construction output. Subsequently, it fluctuated between 70-75 % until 1991 when it rose to 86 % in order to meet renewed immigration. As a result, the construction sector output as well rose sharply in 1990-91. In the 1990s the number of residential units built yearly wavered between 83,000 and 33,000. Since 1997, however, when 53,000 apartments were completed the number has declined steadily to 37,000 during 2001 (the number of units begun being even smaller, 32,000 - the lowest since the 1980s). Once considered a leading economic activity and a barometer of the economy, the construction sector contributed only 6.1 % to the GNP in 2001, down from 30 % in 1950.

While at first almost amount construction was the result of government initiative and investment, between 1958 and 1989 its share fell gradually, from 67 to 16 %. However, it rose again (to 74 % in 1991) when the private sector could not meet the request created by the sudden influx of hundreds of thousands of immigrants. The government's share in construction has since fallen to 23 % in 2001.

- Israel News

-

- ISRAEL: Ethiopian Israelis Could Be Israel’s Best Ambassadors In Africa

- ISRAEL: Izzy Tapoohi spotlights some of the factors contributing to the phenomenal success and value of Israel Bonds.

- ISRAEL: Teva set to win EU okay for $40.5-billion Allergan deal

- ISRAEL: Streaming Giant Netflix Comes to Israel

- ISRAEL: NASDAQ Teams Up with Tel Aviv Stock Exchange to Nurture Israeli Start-Ups

- ISRAEL: Experts Downplay Israeli Mission Closings, Say U.S.-Israel Bonds Not Affected

- Trending Articles

-

- CHINA: Forty-six Chinese-owned companies registered in Guinea-Bissau

- EUROPE: 20 Players With African Roots Playing At Euro 2016

- ALGERIA: Algeria looks to boost capital markets liquidity

- DJIBOUTI CITY: Djibouti takes steps to overhaul banking sector

- TURKMENISTAN: Turkmenistan seeks to raise investments in textile industry

- AFRICA: Ending Africa’s Culture of Impunity

.gif?1338940414)