Austria: Austria Finance Profile

2015/09/03

Austria’s economic increase is set to gain steam, but its banks may face rising challenges in Russia and Ukraine, where they have sizeable exposures. Meanwhile, the re-elected ‘Grand Coalition’ government finally decided on a bad bank solution for Hypo Alpe Adria.

Strengths (+) and weaknesses (-)

(+) Wealthy, well-diversified and competitive economy

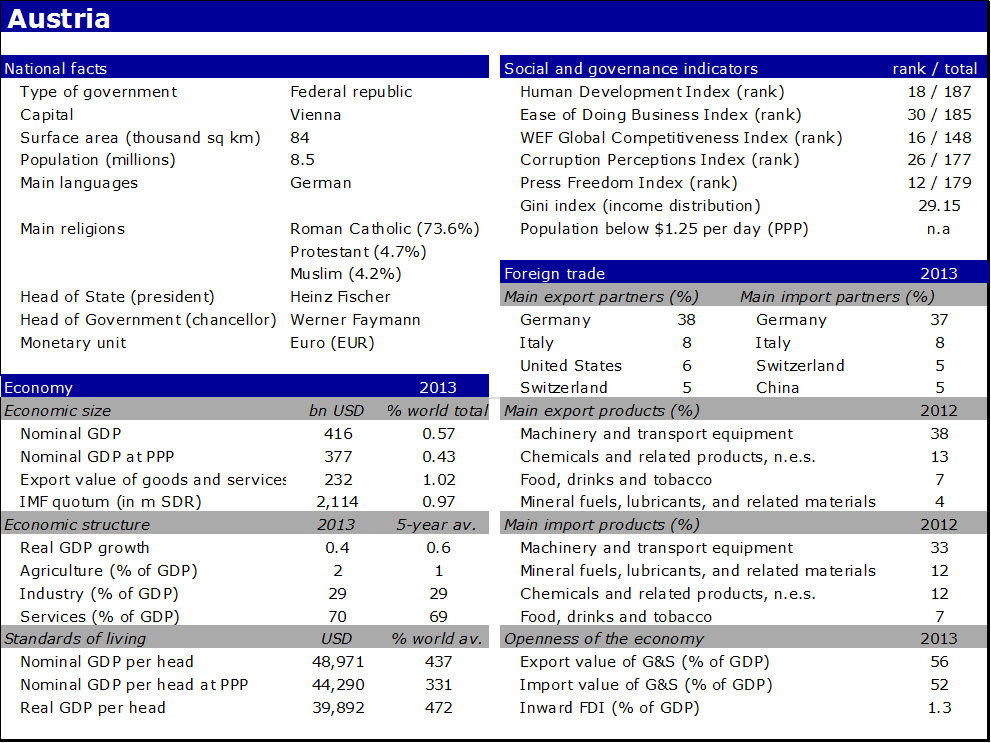

Austria’s small open economy is competitive and highly diversified, featuring various industrial and services sectors, while GDP per capita ranks part the highest within the European Union, which increases its resilience against external shocks.

(+) Favourable geographic location

Being located at the heart of Central Europe with initial-class infrastructure, Austria benefits from its proximity to major industrial centres in Germany and Central and Eastern Europe (CEE), while its manufacturing sector is closely integrated into regional supply chains.

(+) Political stability

Austria’s political and social situation is very stable, as politics remain dominated by two large centrist parties following decades of power sharing at the institutional level. From presently on, this comes at the cost of slow evolution on reforms and rising frustration of the people benefitting fringe parties.

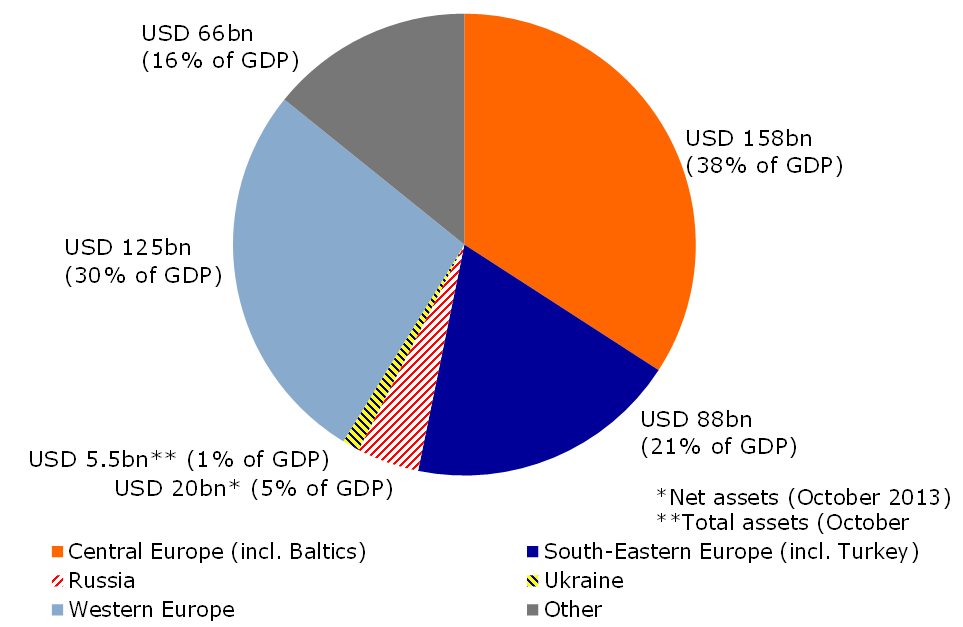

(-) Sizeable exposure of the Austrian economy to Central and Eastern Europe

Reflecting Vienna’s role as a regional centre, Austrian banks and corporations expanded strongly in CEE nations, exposing them to the economic fate of the region. Necessary bank recapitalizations due to credit losses in CEE markets have burdened public finances significantly in recent years.

Key developments

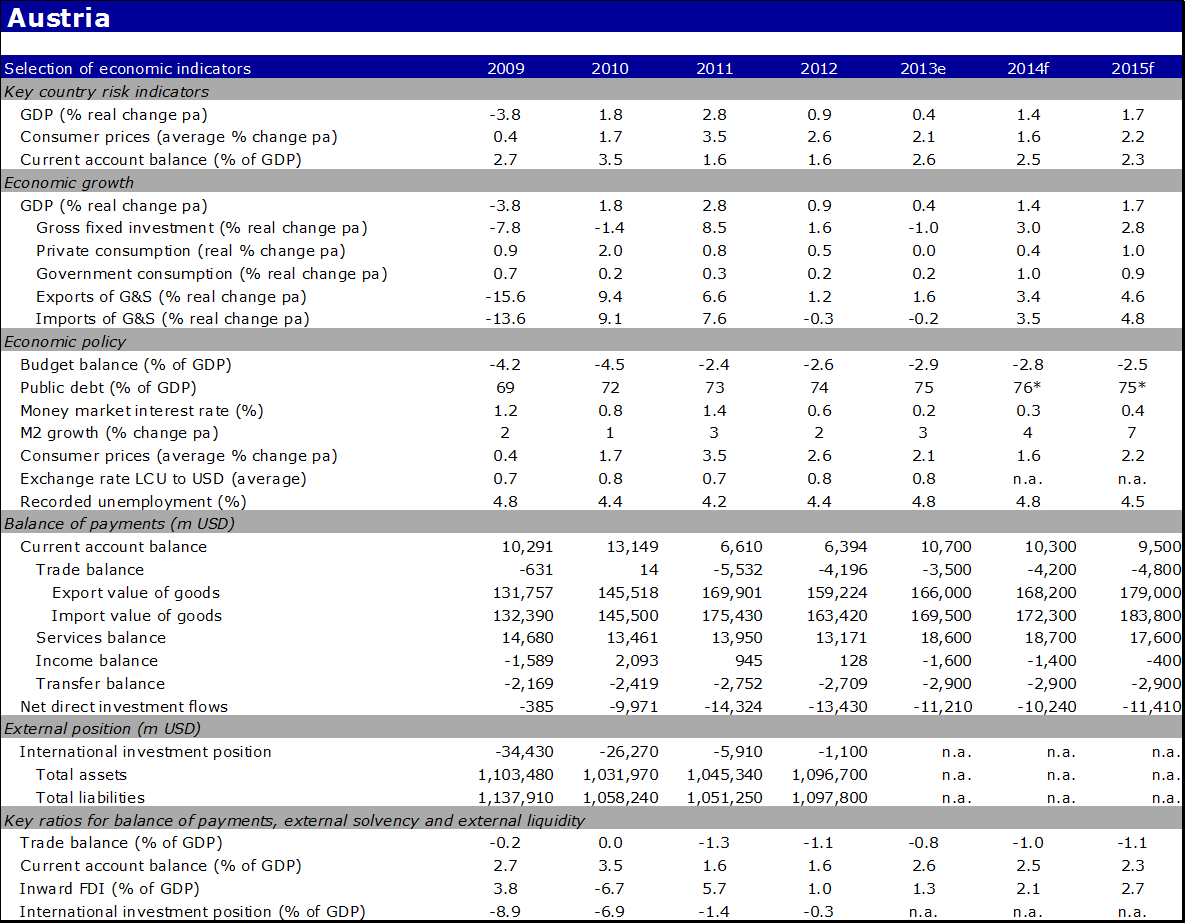

1. Heading for a moderate economic recovery

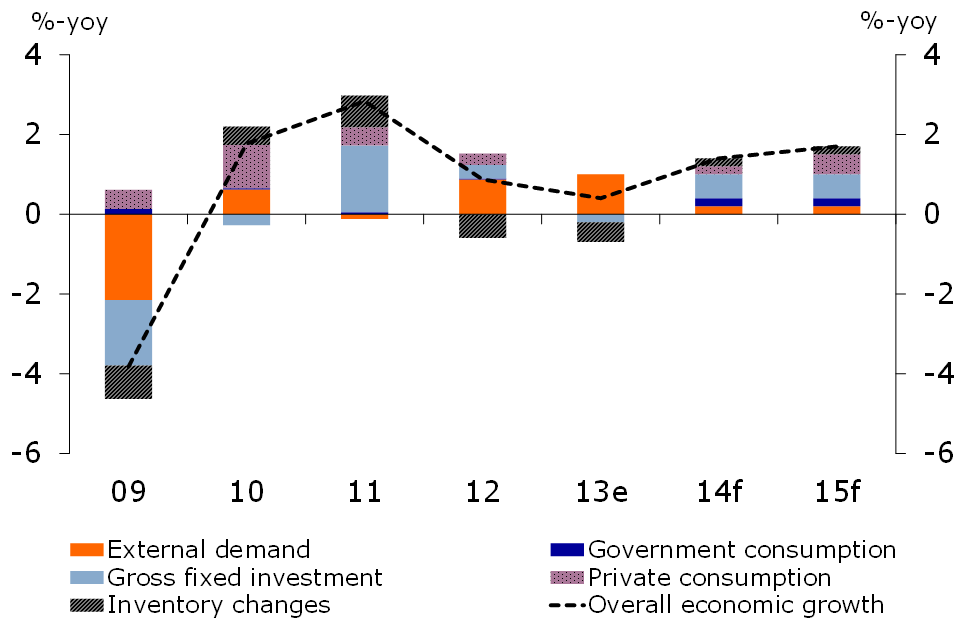

Austria’s economy is expected to embark on a gradual recovery next two years of relatively weak increase, at the same time as economic output expanded by a mere 0.9% and 0.4%, respectively, in 2012 and 2013. Mainly driven by strengthening domestic request, economic increase is expected to increase to about 1.5% this year. It stagnated in the initial half of last year, as private consumption suffered from a marked fall in real disposable household gain, investments declined due to low sales expectations, and export increase suffered amid weak economic increase in CEE and the euro area periphery. Economic developments took a turn for the better in the second half of last year, however, as an development in sentiment and the need to implement long-postponed machinery replacements boosted investments.

This year, relatively high collective wage settlements and low inflation augur well for a strengthening of private consumption, while restocking following a two-year inventory run-down should as well boost increase. The risks to the outlook are fairly balanced. On the upside, Austria’s economy would benefit from a stronger-than-expected recovery in the euro area. Meanwhile, the possible escalation of tensions between the EU and Russia may hurt Central European exports and the supply of raw materials and energy, which could hit Austria’s manufacturing sector hard.

2. From presently on an extra ‘Grand Coalition’ government, but right-wing eurosceptics gain strength

Austria’s ‘Grand Coalition’ government comprising the social-democrat SPÖ and the conservative ÖVP under the leadership of chancellor Werner Faymann (SPÖ) was re-elected on September 29, 2013. However, both parties, which have dominated Austrian politics since the end of WWII, saw their combined absolute parliamentary majority shrink significantly, as various right-wing eurosceptic parties managed to gain a combined 30% of the vote. Receiving 21.4% of the votes cast, the far-right FPÖ ended a mere 1.9 p.p. short of the second-placed ÖVP , while the newly-created Team Stronach party of Austro-Canadian entrepreneur Frank Stronach managed to enter parliament. The far-right BZÖ only just failed to overcome the 4% threshold for parliamentary representation.

The continuation of the ‘Grand Coalition’ will bring with it policy stability, but the coalition agreement rather represents a compromise than an ambitious reform schedule. Besides achieving structurally balanced public finances, as well by means of part-privatizations, by 2016, the government intends to boost social spending and hike bank taxes. Meanwhile, rising frustration with an extra ‘Grand Coalition’ may further boost support for right-wing fringe parties. This may increasingly affect Austria’s stance towards further financial assistance for ailing euro area member states, even as a majority of Austrians still supports membership in the single currency area.

3. Banking sector clean-up progresses, but rising EU-Russia tensions lead to new challenges

After several years of postponing a thorough resolution of the nationalized Hypo Alpe Adria Gruppe (HAAG), Austria’s government finally decided to split HAAG early this year. Part of the bank’s assets (about EUR 18bn or 6% of GDP) will be transferred to a bad bank and its foreign subsidiaries will be sold. The decision came amid renewed capital shortages at the bank that may all to about EUR 2bn this year, which will have to be provided by the government. Given extremely high guarantees provided to the ailing bank by the national of Carinthia, an before-considered and possibly cheaper insolvency of HAAG was from presently on rejected amid concerns about the impact a bankruptcy of Carinthia may have on Austria’s reputation on international financial markets.

The HAAG resolution and an extra recapitalization of ÖVAG bank worth about EUR 200m will increase Austria’s public deficit ratio to about 80% of GDP this year, up from 64% in 2008. Meanwhile, Austrian banks still face challenges due to their heavy exposure in various CEE markets (see figure 2). Even though major improvements have been completed in terms of funding CEE subsidiaries by means of local deposits, market conditions remain difficult in Hungary, the Balkans, inclunding Russia and Ukraine, in particular. While additional sizeable costs may be incurred in Hungary following the Fidesz-party’s election victory, still poor investment quality may force banks to boost provisions and possible even recapitalise local subsidiaries, as has recently been the case in Slovenia.

Following strong expansion in recent years into Russia and Ukraine, Austria banks are part those most exposed to a further escalation of tensions between the EU and Russia, given a combined exposure of about USD 26bn. At the very least, due to the current economic deterioration in both Russia and Ukraine, investment quality and profitability will suffer, while Russian subsidiaries may remain exposed to unfriendly policy actions as the conflict drags on. Meanwhile, rising losses may as well be incurred in various weaker CEE markets, if an escalation of the conflict were to result in marked local currency depreciation given still sizeable amounts of outstanding non-local currency loans.

Background information

Austria is a small and wealthy country in central Europe with a nominal GDP of USD 416bn and about 9m inhabitants (2013). Industrial production and tourism constitute the mainstays of the Austrian economy. Austria’s industrial sector, which is closely integrated into German and central European supply chains, mainly focuses on the fabrication and development of cars, chemical and pharmaceutical produce, inclunding the manufacturing of machinery and electric appliances.

Tourism contributes about 9% of GDP and attracted about 24m foreign visitors last year, mainly from Germany, Italy and the Netherlands. Austria’s once inward-looking banking sector expanded strongly into various CEE nations following the end of Communism in Europe as it strove to boost low profit margins in the saturated local market. While considering central Europe as its home market, operations of the sector in several nations in the region suffer from very poor investment quality and low profitability, half resulting from the large-scale provision of foreign-currency denominated loans. The Austrian government had to repeatedly support financial institutions in recent years, which brought with it a significant deterioration of public finances, as public deficit increased by about 16 p.p. of GDP in the last five years. Since the end of WWII, Austria’s politics have been dominated by various coalition governments comprising the Social Democrat SPÖ and the Christian-Democrat ÖVP, which half led to rising frustration of the electorate with the political system and the emergence of various right-wing parties. Notwithstanding, the impact of the latter on policy-making has been limited so far, as Austria remains a committed EU-member that closely co-operates with neighbouring Germany and central European peers, in particular.

- Austria News

-

- AUSTRIA: Austria Private Sector Growth Maintains Strong Momentum

- AUSTRIA: OPEC, non-OPEC agree first global oil pact since 2001

- AFGHANISTAN: Higher earning Why a university degree is worth more in some countries than others

- AUSTRIA: Minister Nkoana-Mashabane to host her Austrian counterpart

- ALBANIA: Europe in 2016: Terror fears, migration, politics. But economy may turn a corner

- AFGHANISTAN: Global growth will be disappointing in 2016: IMF's Lagarde

- Trending Articles

-

- QATAR: Qatar focuses on preventive care in new national health strategy

- CHINA: Why China and Russia will be best frenemies forever

- NIGERIA: The Federal Government Begs Dangote to Complete Refinery Before 2019

- TANZANIA: Acacia Mining aims resume dividend if Tanzania export ban ends

- EGYPT: Sudan: Egyptian FM to Visit Sudan Wednesday

- BOTSWANA: Africa: How to Adapt to Beat Crippling Droughts