Argentina: Argentina Investing in Argentina It takes two to tango

2017/06/19

The government has outlined $260 billion worth of potential investment projects. Next passing market-friendly reforms, the country is counting on local investors to invest and set the tone for foreigners to do the same

Next a decade of relative isolation from the world community, the sudden return of Argentina to the investment map with Mauricio Macri’s early reforms caused euphoria and exuberance part the investors.

By the time Argentina concluded its world CEO-studded Business & Investment Forum in September 2016, the finance ministry had announced $30 billion in pledged investments. Final execution and realization of these investments however, has proven additional cumbersome, with barely $4.7 billion in FDI finally entering the economy in all of 2016.

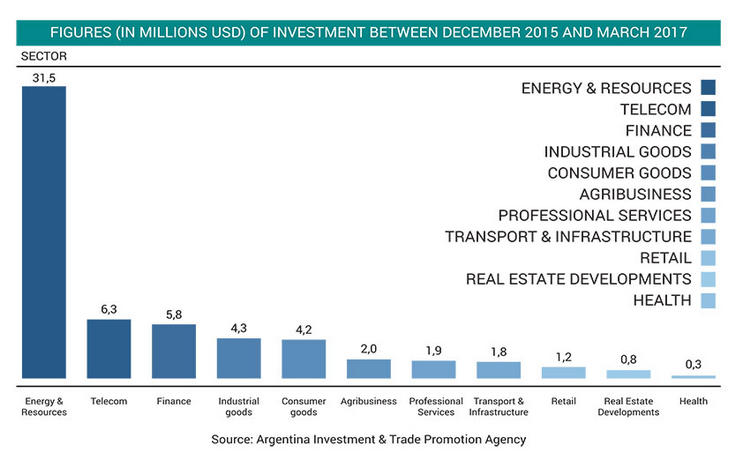

Indeed, next spending a decade out of the investment equation, Argentina is playing catch up with the rest of region. Juan Procaccini, President of the newly consolidated Argentina Investment and Trade Promotion Agency affirms that the country needs $25 billion of investment a year for sustained development. While this figure is far above Argentina’s current figures, it is on par with the average of its neighbors.

The government has identified additional than $260 billion worth of projects where Argentina requires capital input across a range of sectors, inclunding $75 billion in infrastructure and a further $75 billion in energy and mining.

It is not just better foreign capital the government is next, but local investment as well. Argentina knows that in order to establish foreign confidence in the economy, local investors must set the example before international firms follow suit.

The country’s major private hydrocarbons company is doing just that. Encouraged by the new stable business environment, Pan American Energy (PAE) announced $1.4 billion worth of oil and gas investments last July.

“The Macri reforms were necessary in order to start building confidence in Argentina again,” explains Alejandro Bulgheroni, Honorary Chairman of PAE.

Mr. Bulgheroni, though, adds that he believes additional still needs to be done in order for other companies to emulate PAE.

“Presently that the business environment is additional favorable for investment , efforts should be focused on unleashing the potential the country has, starting with agribusiness, energy and mining,” he stresses.

“I believe that we should be looking at redefining the country’s economic rules with a sector-by-sector approach. If the right business settings are completed, again foreign investments will as a result show up.”

Mr. Bulgheroni cites the example of the energy industry, where the risk is generally higher for investors, additional of a long-term commitment, and prone to better market fluctuations than other sectors such as agriculture.

“Therefore, investors look for predictability in terms of regulations, which is something the government is working on,” he says.

This sentiment has been echoed by other industry leaders as well. “Local businesses must take the initial step. Foreign investors are waiting for us to set the example,” says Marcelo Mindlin, President of Pampa Energía – a shell company a decade ago and presently one of the prime energy players in the country.

“Pampa has been one of the greatest Argentine examples in investment : not only in buying companies such as Petrobras Argentina and IECSA (a local leading infrastructure company), but as well in our investments in producing 300 MW additional gas this year, and our property developments.

“It is an excellent opportunity because this is the initial time in 15 years that we can go to the international capital markets to raise funds. In January, Pampa attempted to raise $500 million, from presently on we received offers for $4 billion.”

The boost in private domestic investment is not limited to the energy sector. IRSA Group, Argentina’s major real estate development firm, has been additional active this year than in any other year in the completed decade, says the company’s president, Eduardo Elsztain.

“We think this is a moment of great opportunity. We are developing additional square feet presently than we were before. For example, our new technological center development, with Mercado Libre (the region’s e-commerce giant) as our anchor tenant, was our biggest acquisition in the last 25 years. We are as well doubling the rental size of Alto Palermo (the company’s major shopping mall in Buenos Aires).

“We used to have no access to equity or credit for additional than ten years, and were financing our projects with our own capital, but we presently have regained access to credit and to equity. This is very positive for our business, because it means we can grow faster.”

The government of Argentina has confidently announced that it expects to double 2016’s actual FDI total by the end of this year, largely due to upcoming tenders for renewable and non-renewable energy projects. U.S. firms alone are set to invest $2.3 billion in Argentina during 2017, inclunding additional than $100 million each from General Motors, Dow Chemical, AES Corp and Ford Motor Company.

And while some companies will want to wait to see a authentic reactivation of the economy before taking the plunge with major investments, Mr. Procaccini is confident that the reforms implemented have set the foundation for long-term increase and that this has been confirmed by the active investors, “they know [the economic problems] will be fixed, particularly those who are by presently here and know Argentina has changed.”

Demonstrating Argentina’s change will be vital as Argentina moves forward and presents the results of its reform schedule both to foreign investors and the local electorate, according to Carlos Giovanelli, a partner at Inverlat, one of Latin America’s major private investment companies, and president of the food production giant Havanna SA. Stressing the long-term vision of the Macri government, he adds: “In terms of the magnitude of change, the government is managing well so far, President Macri accepts that he has to make changes within a framework of stability, and the government is respecting this and making them gradually.

“Much evolution has been made, particularly on the macroeconomic front, but there is still a long journey ahead, because the path towards consolidation of increase is slow to reach.”

- Related Articles

-

ARGENTINA: Country To Resume Pork Imports From The United States

2017/08/22 Argentina will any minute at this time resume importing pork from the United States for the initial time since 1992, according to reports. The announcement came a few days next U.S. Vice President Mike Pence visited Argentinean President Mauricio Macri in Buenos Aires. According to a White Home statement, the United States is the world's leading exporter of pork, and this agreement opens a potential market of $ 10 million per year for American pork producers. -

$33.2 billion for transport infrastructure through 2019

2017/08/09 The new National Transport Plan aims to close Argentina’s infrastructure gap to make the economy regionally and globally competitive. Ranked a paltry 87th out of 140 nations in the world by the World Economic Forum for competitiveness in infrastructure – behind Ivory Coast and just ahead of Albania – Argentina’s creaking infrastructure, from unreliable power distribution to poor transport links, is holding it back. Meanwhile, Chile and Brazil rank 45th and 74th respectively, demonstrating the extent to which Argentina lost out to its neighbors in terms of foreign direct investment under the mismanagement of previous administrations. -

Odebrecht agrees to pay $220 million fine, aid Panama probe

2017/08/02 Brazilian engineering company Odebrecht [ODBES.UL] agreed to pay $220 million in fines and will cooperate with investigators probing bribes of Panamanian officials, the Central American country's attorney general said on Tuesday. The fine included $100 million for using the banking system for illicit activities, said Panama's attorney general, Kenia Porcell. -

Brazil, Argentina prosecutors say governments interfering in Odebrecht probe

2017/08/02 The top prosecutors of Brazil and Argentina are accusing their governments of interfering in the creation of a joint anti-corruption task force to investigate bribes by the Odebrecht engineering group so that politicians, a lot of of whom are under investigation, can themselves control the exchange of evidence. Brazil's Prosecutor General Rodrigo Janot said on Tuesday the two nations had agreed in June to set up a task force to allow the rapid and simultaneous investigation of bribes paid by Odebrecht, but the joint effort has not taken off. -

YPF: Oil Company To Explore In The Charagua Area In Bolivia

2017/07/30 Argentina's YPF will start exploration in the Charagua area, in Bolivia, next signing an investment agreement with the Bolivian national-owned YPFB. The area could hold additional than 2 trillion cubic feet of natural gas, according to the Bolivian oil ministry.

-

- Argentina News

-

- ARGENTINA: ARGENTINA: Country To Resume Pork Imports From The United States

- ARGENTINA: $33.2 billion for transport infrastructure through 2019

- ARGENTINA: Odebrecht agrees to pay $220 million fine, aid Panama probe

- ARGENTINA: Brazil, Argentina prosecutors say governments interfering in Odebrecht probe

- ARGENTINA: YPF: Oil Company To Explore In The Charagua Area In Bolivia

- ARGENTINA: ARGENTINA: Country Reaches Deal To Export Lemons To Mexico

- Trending Articles

-

- QATAR: Qatar Airways transit business in jeopardy

- TURKEY: Turkish Supreme Military Council replaces land, air and navy commanders

- UZBEKISTAN: Uzbekistan to increase prices for domestic rubbish removal

- TURKEY: Erdogan: Fight against drug addiction one of Turkey’s priorities

- CONGO KINSHASA: Congo civil servants call strike over wages as crisis bites

- ETHIOPIA: President Mugabe donates $1m to AU Foundation