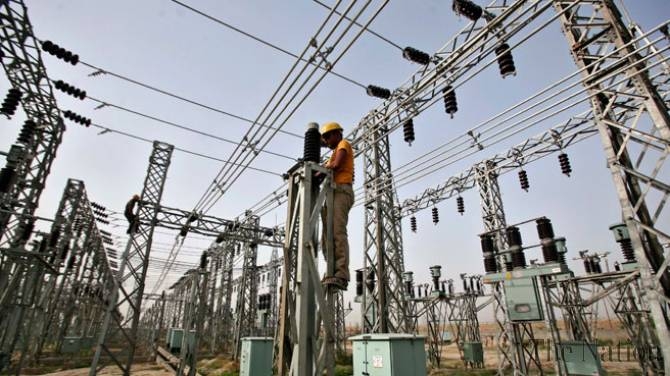

Nigeria: Nigeria’s power sector goes private

2015/12/20

The privatisation of Nigeria’s power generation and distribution assets has paved the way for an increase in electrification, although ongoing issues with gas supply and distribution are proving a challenge.

The government is looking for better private sector involvement to boost investment in the sector, which needs some $65bn worth of capital spending to reach the country’s target of 40,000 MW of generation capacity by 2020, according to Nigerian Bulk Electricity Trading.

Window of opportunity

The rationale behind the privatisation push – which was several years in the planning but finally materialised in 2013 – is clear: inefficiencies in Nigeria’s power sector have traditionally been a major constraint to increase, costing the 170m-person economy as much as $100bn per year, according to government estimates.

With only two-thirds of the people currently receiving electricity, Nigeria ranks part the worst performers in the world at the same time as it comes to power, according to the World Bank’s most recent “Doing Business” statement. Nigeria placed 182nd out of 189 nations surveyed in terms of relieve of getting electricity, behind South Africa (168th) and Kenya (127th). Meanwhile, request increase is continuing apace, estimate to rise by 10% per annum through to 2020.

The lack of a reliable supply of electricity is seen as an impediment to increase in Nigeria’s industrial sector in particular, adding to the cost of doing business for a lot of firms. Companies frequently need to rely on backup diesel-fuelled generators, which run at a cost of $0.30-0.50 per KWh, compared to the average grid tariff of $0.13.

While Nigeria has additional than three times the people of South Africa, it has just one-ninth of the installed generation capacity. Output traditionally has not exceeded 5000 MW, according to local media reports, which is roughly one-third of peak request.

Private successes

To help address generation concerns and encourage private investment , in 2013 the government began a partial privatisation process that led to the sale of 15 national generation and distribution companies, before included under the umbrella of the Power Holding Company of Nigeria. The sale generated additional than $3bn, according to local media reports.

The privatisation was something of a landmark moment for the country, and should provide significant long-term benefits in terms of power provision. However, it has not been completely smooth sailing: the Central Bank of Nigeria launched a NGN213bn ($1.1bn) bailout package in September 2014 to cover revenue shortfalls and help with deficit servicing on NGN500bn ($2.5bn) of bank loans across the sector.

Nonetheless, certain power plants have seen improvements as a result of the scheme. In particular, the Ughelli Power Plant – the country’s major fossil fuel generation plant – has increased power generation additional than five-fold in the completed two years, and is expected to deliver an extra 760 MW by the end of 2015, according to Adeoe Fadeyibi, CEO of Transcorp Power, which manages the plant.

The country’s major power plant, the 30-year-old Egbin Power Plant in Lagos, has as well boosted its output, from less than 50% of capacity to 85% since Nigeria’s Sahara Group and Korea Electricity Power took over management in 2013. The plant presently generates an average of 1100 MW, according to the company.

The privatisation of existing assets has as well been complemented by the arrival of new producers, with the Nigerian Electricity Regulatory Commission having recently issued 70 licences for independent power plants (IPPs). In August the federal government announced that the 450-MW Azura-Edo IPP – an open-cycle gas turbine project that is part of a larger 1500-MW IPP facility planned for Edo National – had reached financial close and is expected approaching on-stream in 2018.

Additional scope for reform

To maintain the current momentum, efficiency in other parts of the supply chain will as well need to be improved. For example, access to gas remains a challenge, limiting a source of key inputs for power generators.

Despite boasting 180trn cu feet of proven gas reserves – the major store on the continent – the guaranteed supply of gas to existing thermal generation plants in Nigeria, which account for 80% of the country’s on-grid power, remains a key concern for industry stakeholders.

Currently, only 14% of domestically produced gas is sold to the local market, with 38% exported as liquefied natural gas, an extra 24% flared and the remainder re-injected to be used as fuel or processed into other liquids, according to Philip Ihenacho, CEO of local oil and gas company Seven Energy.

Gas producers sell a set quota of gas to the domestic market at a fixed non-commercial rate, which reduces the incentive to invest in costly gas infrastructure upgrades. Pipeline vandalisation as well serves as a deterrent to further investment , due to the cost of repairs and additional security measures needed to guard the vulnerable spots along the network.

According to Michael Larbie, CEO of Rand Merchant Bank Nigeria and West Africa, a additional liberal pricing regime could create the fiscal space needed for private investment to flourish. “The regulator must allow market dynamics to dictate the optimal tariff levels, as this will enable investors to get a return on their investment and put additional money into the system,” he told OBG.

- Related Articles

-

Nigeria’s e-commerce industry shows growth potential

2016/06/18 Recent investments demonstrate sustained investor interest in e-commerce platforms in Nigeria, which boasts the continent’s major people and economy. Ombola Johnson, the former minister of communications technology, predicted Nigeria’s e-commerce industry will reach a valuation of $10bn in the years ahead, with some 300,000 online orders expected each day. This increase would be in line with trends throughout the wider continent, with consultancy McKinsey estimating that the African e-commerce market is on track to reach $75bn in revenues per annum by 2025. -

Routes Africa forum aims to improve African air connectivity

2016/05/15 An event dedicated to the development of the African aviation industry will take place next month in Tenerife (26-28 June) to encourage the launch of new air services to, from and within the African continent. Routes Africa 2016 will help to improve African connectivity by bringing together airlines, airports and tourism authorities to discuss next air services. Around 250 route development professionals are expected to attend the forum which was founded ten years ago to stimulate increase in the industry. -

Anger Overflows in Nigeria as Economy Dives

2016/05/13 Young men became entangled in a swirl of flying fists. Gas station workers swatted away boys hoping to fill their plastic cans. A mother with a sleeping baby in her minivan was chased off, rightly accused of jumping the line. A driver eager to get ahead crashed into several cars, the sound of crunching metal barely registering amid the noise. Nigerians were getting used to days like this. But again came the ultimate insult to everyone waiting at the Oando mega gas station: A bus marked Ministry of Justice rolled up to a pump, leapfrogging no fewer than 99 vehicles. “Service With Integrity” was painted on its door. A gas station supervisor who calls herself Madame No Nonsense stepped aside to let it fuel up before anyone else. The crowd howled at the injustice. -

While Europe is on the verge of breaking up, Africa is reaping the benefits of integrating, growing and developing its trading blocks

2016/05/13 The collapse of virtual borders is one of the majority remarkable things to have happened in our lifetimes. In the world of cyberspace, time and distance have become almost peripheral considerations at the same time as it comes to doing business. Services from software development to accounting can be delivered across the world in the blink of an eye. Next business leaders will struggle to imagine an era at the same time as communication was neither immediate nor virtually free. -

Africa’s economic growth is likely to be slower in the intervening years

2016/05/12 Africa’s economic increase is likely to be slower in the intervening years than in the before decade, according to the new rating by Ernst & Young using a barometer to gauge the level of appeal and success.“The baseline projection of the International Monetary Fund (IMF) for 2016 is presently reduced to 3%, while it was estimated at 6.1% in April 2015″, Ernst & Young points out in its rating.

-

- Nigeria News

-

- NIGERIA: Nigeria’s e-commerce industry shows growth potential

- BOTSWANA: Routes Africa forum aims to improve African air connectivity

- NIGERIA: Anger Overflows in Nigeria as Economy Dives

- BOTSWANA: Economic integration is helping boost trade and investment in Africa

- BOTSWANA: Africa’s economic growth is likely to be slower in the intervening years

- BOTSWANA: Beyond Commodities: How African Multinationals Are Transforming

- Trending Articles

-

- KENYA: Kenya's tea industry moves toward strategic diversification

- CHINA: Forty-six Chinese-owned companies registered in Guinea-Bissau

- GHANA: Ghana steps up to secure electricity supply

- TUNISIA: Tunisia augments ICT exports and connectivity

- INDIA: Indian central bank chief to step down in surprise move

- NIGERIA: Nigeria’s e-commerce industry shows growth potential

.gif?1356023993)

.gif2_.gif?1356029657)